FinTech Magazine's 2024 lookahead: Real-time payments

As we look ahead to 2024, FinTech Magazine has gathered insight and expertise from dozens of leaders representing companies operating right across the financial services spectrum.

In this instalment, the focus is on the future of real-time payments.

Andy Davies, Global Head of Payments at Endava

In 2024 we’re set to see a positive shift as real-time payments build momentum within the cross-border payments space. Innovations to overcome the current lack of transparency and control around where money is within the system will continue to emerge, enabled by the much richer data landscaped that comes with the shift to ISO20022 – especially where this data aids Know Your Customer (KYC) and Anti-money Laundering (AML) compliance.

The B2B space stands to benefit the most from modern cross-border payments because it accounts for 80% of all cross-border transactions but the much greater transaction values involved requires hardened security to ensuring transactions are reliable and losses from fraudulent activity are prevented. Inevitably this means that B2B payments will attract greater friction in terms of authentication and consent.

Organisations will need to consider the new industry trends with cross-border payments alongside new banking standards and practical applications of current and upcoming developments. In the new world of borderless transactions, investing the time and technology in improving the cross-border payment experience will be critical to not only frictionless payments but also growth, liquidity management and risk mitigation.

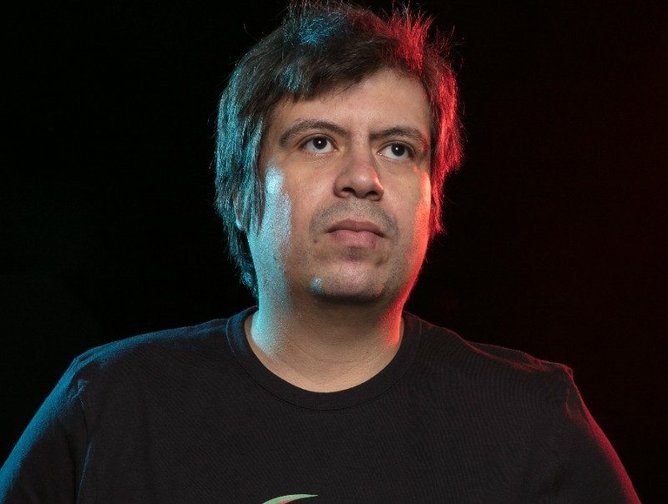

Manuel Sandhofer, SVP & General Manager, Europe at Nium

It’s no secret that the financial services sector is undergoing a seismic shift in digital transformation. Frictionless cross-border payments are a crucial catalyst of this change, enabling economies and businesses around the world to increasingly become more global. If 2026 will be the year that the global payments system reaches US$3 trillion (as McKinsey predicts), 2024 must be the year that we begin to fully unlock this potential and pave the way for transformational growth.

Next year, new regulation such as an updated PSD2/3 framework and the development of the New Payments Architecture in the UK will create new challenges for business leaders while opening the doors to payment innovation. As a result, traditional banks will face even more competition from digital disruptors, driving strategic fintech partnerships to keep pace with the evolving needs of their customers.

Beyond traditional remittance services, we can also expect new use cases for real-time global payments to continue to emerge in 2024. Whether its online marketplaces sending funds to their global merchant sellers, streaming platforms paying their content creators around the world or insurance companies disbursing claims to businesses across borders, we’re seeing many industries begin to embrace real-time global payment infrastructure.”

Luis Silva, Founder and CEO at CloudWalk

Instant or real-time payments between consumers and merchants is the new norm in several countries around the world, but the US is lagging behind on adoption, resulting in local merchants not being able to reap the benefits of having instant access to their cash flow.

While ACH, Fedwire and credit/debit card-based processes are the status quo in the US right now, the pendulum is going to swing towards instant payments in the coming year following the Federal Reserve’s recent launch of FedNow.

Most US fintechs will look to incorporate instant payments into their offerings next year, especially given the high-interest-rate environment.

Together with instant payments, we have Tap to Pay technology – which transforms any smartphone into a payment machine – ramping up. Apple is betting on the technology and launching Tap To Pay on iPhone in the main markets worldwide. So, basically, we are talking about a quite different way of merchants getting payments next year.

Nick Botha, Global Payments Manager at AutoRek

“2024 will see the next natural phase in real-time payments. Modern consumers already expect instant payments, with payment innovations like QR codes and Request to Pay leading to irreversible changes in the way that end users make payments. The direct link between real-time payments and economic growth is opening governments’ eyes to its potential, leading to a central push towards widespread adoption next year and beyond.

Instant payments are set to become ubiquitous for both national and regional payments networks as central banks continue developing real-time infrastructure to satisfy consumer demand. Evolving developments in Central Bank Digital Currencies (CBDCs) and work on emerging payments infrastructure will cement real-time payments as more than a ‘nice to have’ in most markets, and ensure they are well on the way to becoming a mandatory part of bank and payment firms’ propositions.

But the central push towards real-time payments will add pressure to the back and middle office as firms battle to accommodate higher-transaction volumes. Firms will need to ensure their existing infrastructure and systems are set up to process payments in real-time and keep up with consumers’ ever-evolving spending habits.

******

Make sure you check out the latest edition of FinTech Magazine and also sign up to our global conference series – FinTech LIVE 2024.

******

FinTech Magazine is a BizClik brand.

- Money 20/20 USA: Veridas on Voice Biometrics in FinservFinancial Services (FinServ)

- Volante Technologies: Faster Payments Priority for US banksBanking

- Mangopay & Storfund: Enabling Immediate Payment for SellersDigital Payments

- McKinsey & Company Heralds new era for FintechFinancial Services (FinServ)