Richard Hobbs

Group IT Director at The Royal Mint

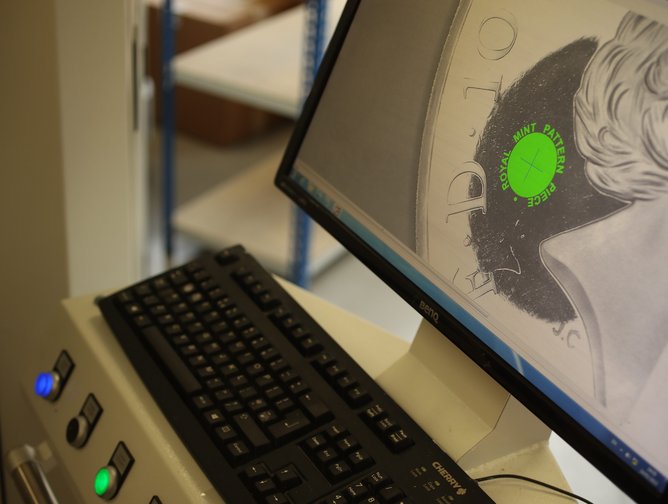

Having worked in financial services for two decades, Richard Hobbs was energised by the prospect of leading a digital transformation for one of Britain’s oldest companies.

After leaving university, Hobbs went on to work with some of the UK’s most renowned brands including Barclays, Lloyd’s and Admiral, but knew joining The Royal Mint – with the remit of driving forward its digital transformation – would make for an exciting change of pace.

“Twenty years is a long time to be in financial services,” he admits. “Sometimes, you feel like you're doing the same thing with a different badge on it. So, coming to The Royal Mint, with its rich heritage, was a great opportunity. There aren’t many businesses out there where a product sits in every person’s pocket; I found that really enticing.

“It also looked like a place where I could thrive and develop my skills. It was perhaps an unusual step to take, but I’m delighted I made the move.”

A new direction

Hobbs joined The Royal Mint as Head of Applications just over three years ago, in January 2020. Then, a matter of days before COVID-19 forced the UK into lockdown, he was offered the interim CTO role. Over the ensuing six months, he was tasked with navigating the historically traditional institution’s sudden transition into the remote work era, which was, unsurprisingly, “a real challenge”.

He also recognised the growing importance of innovation within the technology function and formulated a plan to bring new technologies into the business. Having become Group IT Director in September 2020, Hobbs set about driving the Mint’s technology strategy to make it as agile as possible, growing his team of 23 to almost 60 in the process.

“What we’ve built is a really modern technology function,” he says. “We’ve brought in a delivery team of business analysts and project managers; we’ve grown the development function so that our website can be quick, nimble, and effective responding to customers; and we've done some great work in bringing talent into our cybersecurity team by engaging with the local university.”

An exciting crossover of industries

There is palpable enthusiasm, and even fascination, on display when Hobbs discusses what it’s like working for The Royal Mint. A major contributing factor to that passion is being able to see different industries come together as one.

“Everyday in the canteen queue you’re standing next to coin engravers, jewellery makers, die workers and chemists,” says Hobbs. “But there's no escaping the fact that technology is a key enabler for The Royal Mint’s strategy and, as such, I spend most of my time with people in the technology space.

“It’s also great to be in an industry that is transforming at the same sort of pace as technology. You only have to look at the ‘factory of the future’ to recognise manufacturing is moving as fast as technology allows it.”

Hobbs backs up his enthusiasm with an explanation of what drives him from a career perspective. “I’ve got a passion for interesting work,” he concludes. “I’ve never been driven by a desire to get the corner office. It’s always been a question of what can challenge me and keep me engaged. That’s what drew me to The Royal Mint.”

Read the full story HERE

Featured Interviews

The key benefits for us in automation are reducing manual processes, reducing manual mistakes, and improving our efficiencies