Standard Chartered unveils plans for Mox virtual bank

Standard Chartered has provided further detail of its Mox virtual bank, which it aims to launch this year

Mox offers a "brand new banking experience". The new virtual bank is backed by Standard Chartered in partnership with HKT, PCCW and Trip.com. According to Standard Chartered, Mox is currently in beta testing by staff.

When launched, Mox will deliver a suite of retail banking services alongside "lifestyle benefits", all in one central location that, according to its website, is dedicated to "growing your money, your world and your possibilities".

Redefining banking

Mox operates differently to other banks; it's focus is on making the banking experience better for customers and helping them and their finances grow, regardless of how large or small their goals.

These customers are affectionately know by the bank as 'Generation Mox' - individuals who aspire to live life to the fullest and, collectively define new experiences relating to money, exploration, mobile and more.

.jpg)

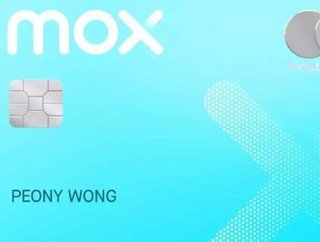

What does that mean practically? It's relatively simple, and revolves around the new Mox Card, a banking card that has been redefined with innovation, security and privacy at the fore.

Mox Card

"The only card you'll need", according to Mox, Mox Card can be used for all purchases and cash withdrawals. It is a numberless physical card, reducing the risk of personal information loss - it can also only be accessed through a user's Mox app.

Mox equips customers with financial management tools, information and insights, all through products that have been designed through customer research and are, therefore, tailor-made for the needs of modern baking customers.

"Mox operates in a whole new way by listening to customers and focusing in heart share," says CEO Deniz Güven. Prior to joining Mox, Deniz was the Global Head of Digital for Standard Chartered. He added that Mox aims "to be the first bank to empower Hong Kong customers to grow and unlock more possibilities by providing a truly digital and personalised banking experience."

SEE MORE:

- Coronavirus: impact on bitcoin price and possible recession

- FinTech profile: Lendio, the small business loan innovator

- Mastercard confirms Michael Miebach as new Chief Executive

- Read the latest edition of FinTech Magazine, here

For more information on all topics for FinTech, please take a look at the latest edition of FinTech magazine.

- Volante Technologies: Faster Payments Priority for US banksBanking

- WEF and Cambridge University Unveil Future of Fintech ReportFinancial Services (FinServ)

- Why Recurly is Trusted by Industry-leading OrganisationsFinancial Services (FinServ)

- McKinsey & Company Heralds new era for FintechFinancial Services (FinServ)